Market Trends for Medical Sales Reps, Distributors, Medical Product Manufacturers, and Start-Up Companies

Following the Emerging Healthcare Market will influence the potential of your success as an independent consultant, independent sales rep, and independent healthcare provider. The healthcare and medical sales market trend is influenced by a number of demographic and market-related trends including the growing and aging population, Reimbursements, Technology, Disease States, Consumer Education, Innovation, Venture Capital, Investors, and Research to name a few. Early diagnosis, prevention, and lifestyle changes are facilitated by emerging diagnostic technologies and variable market-related trends.

Regardless of your role, from the “New Idea to Concept” to Sales and Distribution, understanding and embracing the market trend can have an enormous impact on your success.

Market Trend of Investments in Start-Up Medical Companies based on Body Parts

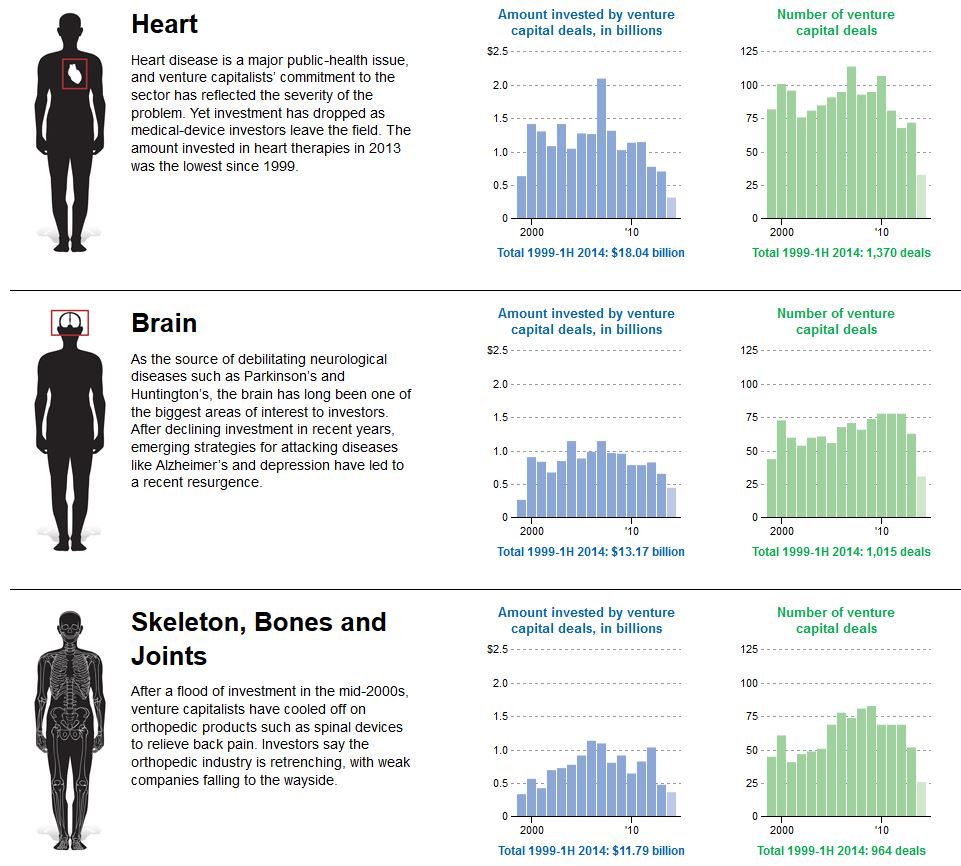

Investors play a very important role in product development and new therapies entering the market. Interestingly, a Wall Street Journal analysis was released where investment trends were monitored since 1999 based on body parts. Yes, body parts!

Anatomically, where are investors investing their money and what direction will you take as a result of this knowledge?

Market Trend of Top Medical Sales and Medical Product Development Markets in the past Decade

It is, without doubt, the topmost successful areas for our independent network over the past decade has been within the development and sales in the cardiac, orthopedic and neuro markets. However, with increased regulations and heavy competition entering the market start-ups are failing and a shift in direction is pending, based on a recent WSJ report. Check our listings of independent sales job opportunities.

Cardiac-related startups received the most Venture Capital funding

Cardiac ranked number one as the total dollar amount invested from 1999 – 2014, topping at over $18B. However, Cardiac related investments were at its lowest in 2013 since 1999, dropping from $2.1B in 2007 to $0.32B in the first half of 2014. The Brain, (neurological diseases) took overall second place with $13.17B invested from 1999-2014 and $0.45B the first half of 2014. Interestingly, Orthopedics went from its highest in 2006 at $1.14B to $0.37B in the first half of 2014 and coming in 3rd overall with $11.79B from 1999-2014. A survey of 6,800 reps reflected independent reps prefer selling with a Start Up Company over a Big Brand Company

What body parts “Sees” the highest investment changes in the first half of 2014?

The Eyes come in first with the Ears following!

The Eyes come in first with the Ears following!

The eyes received the highest venture investment in 2013 with over $848M and $442M in the first half of 2014. This is attributed to our aging population driving innovations. According to the CDC, more than the 3M Americans over the age of 40 have impaired vision. Since 1999, the number of investments has doubled from 27 to 54 deals in 2013.

The report also reflects a surge in 2013, as compared to investments since 1999, with the first half of 2014 hitting $114M while for all of last year there was a total of $76M. Ears came in overall at 5th place receiving $800M in funding as the result of 87 deals from 1999 to the first half of 2014.

The Wall Street Journal report (from Data provided by VentureSource, a database owned by Dow Jones & Company) identified market trend investment dollars by body parts and provided the total amount invested in Venture Capital deals from 1999 through the first half of 2014.

Body parts that received the most funding in descending order was:

- Heart: $18.04B from 1,370 deals

- Brain: $13.17B from 1,015 deals

- Skeleton, bones, and joints: $11.17B from 964 deals

- Endocrine gland and pancreas: $10.65B from 712 deals

- Eyes: $9.07B from 653 deals

- Immune System: $8.49B from 556 deals

- Intestine: $6.3B from 417 deals

- Blood: $6.31B from 396 deals

- Stomach: $5.75B from 378 deals

- Lungs: $5.64B from 422 deals

- Skin: $5.14B from 297 deals

- Kidneys: $4.87B from 334 deals

- Reproductive System: $3.45B from 284 deals

- Muscles: $2.41 from 181 deals

- Urinary System: $1.12B from 88 deals

- Ears: $0.8B from 87 deals

- Liver: $0.41B from 16 deals